Explain Difference Between Credit Risk and Market Risk

These loans and securities have differing interest rate structures some are fixed and some are floating. It is more secure than any other debt.

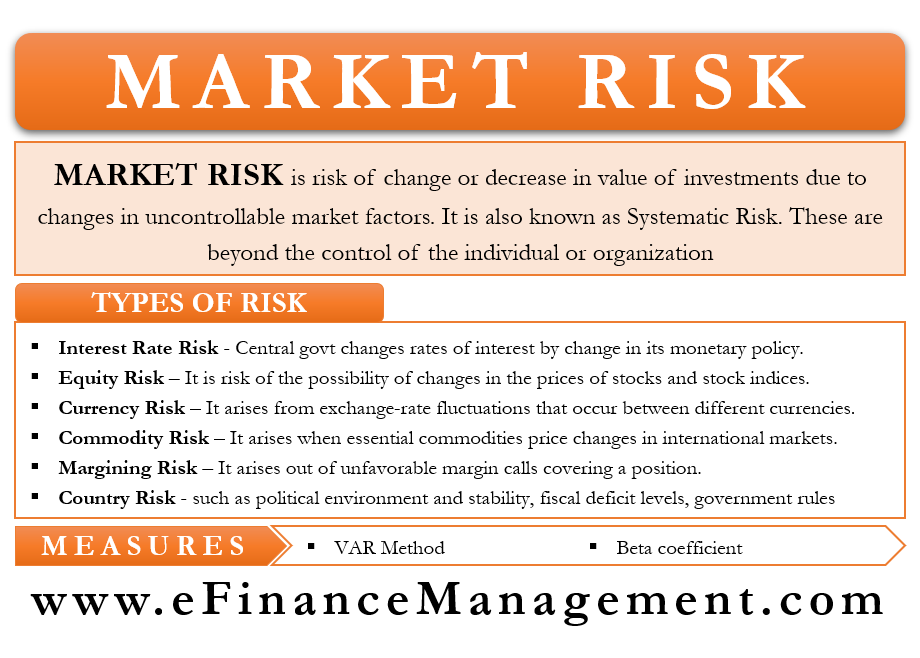

Market Risk Meaning Types Measure Regulations

First the time frame over which we measure the P.

. Market risk refers to the possibility of losing money on financial asset. The Lender and The Borrower. Options Futures and Other Derivatives 6th.

Under the umbrella of market risk are. Up to 5 cash back Earlier chapters focused primarily on market risk so it is useful to highlight some differences between credit risk and market risk. The difference between market risk and credit risk.

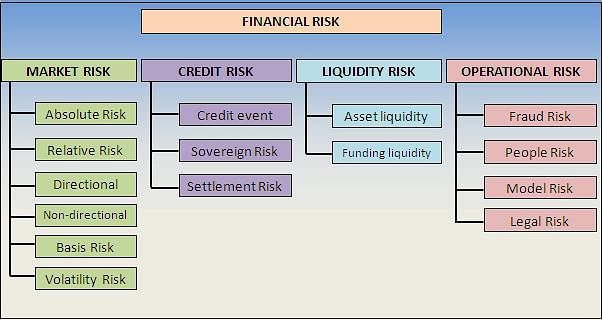

Explain the differences between market risk credit risk liquidity risk and operational risk This problem has been solved. Suppose that a local government invests in 20-year US. They also have differing maturities.

Different Types of Market Risk. Explain the difference between credit risk and the market risk in a financial contract. Risk arising due to the fluctuations in the financial assets.

Briefly there are currently three. A To Z Homework Complete Homework Solution by AtozHomework. Credit Risk arises when the borrower defaults to honour the repayment commitments on their debts.

The risk emerging because of non-payment of debt by a borrower. Explain the difference between the credit risk and the market risk in a financial contract. Explain the differences between market risk credit risk liquidity risk and operational risk.

Credit risk is the risk of loss that may occur from the failure of any party to abide by the terms and conditions of any financial contract principally the failure to make required payments on loans. Explain the difference between the credit risk and the market risk in a financial contract. The difference center around specific issues.

Second the asymmetry and skew of the PL distributioncredit risk. Experts are tested by Chegg as specialists in their subject area. Credit risks are calculated based on the borrowers overall ability to repay.

Market risk is different than credit risk. Senior Debt Senior Debt is money owed by a company that has first claims on the companys cash flows. In market risk the sensitivity to interest rates and equity prices is generally dominant whereas in credit risk the bond portfolio is the most important point of attention for many insurers.

The risk arising out of the variations in the currency rates. Consumer credit risk can. Explain the difference between the credit risk and the market risk in a financial contract.

What are the differences between market risk credit risk and legal risk. Credit Risk 2. Credit risk arises from the possibility of a default by the counterparty.

Interest rate risk arises from unanticipated fluctuations in the interest rates due to monetary policy measures undertaken by the central bank Federal Reserve The Fed The Federal Reserve is the central bank of the United States and is the financial authority behind the worlds largest free market economy. Credit risk is the possibility of losing a lender takes on due to the possibility of a borrower not paying back a loan. 3 ii Explain why an investment bank which has arranged two offsetting single currency interest rate swap contracts still faces credit risk.

The higher the perceived credit risk the higher the rate of interest that investors will demand for lending their capital. Who are the experts. Assess each of the three risks and discuss the disclosures required by a government on its nancial.

See the answer See the answer See the answer done loading. Explain the difference between the credit risk and the market risk in a financial contract. Annamalai University MBA Solved Assignments.

Credit risk is closely tied to the potential return of an investment the most notable being that the yields on bonds correlate strongly to their perceived credit risk. Market risk also called systematic risk cannot be eliminated through diversification though it can be hedged in other ways and tends to. A corporate treasurer tells you that he has just negotiated a 5-year loan at a competitive fixed rate of interest of 52.

IAs such it mainly deals with two main parties. The banks assets are mostly invested in loans and securities about 90 of average assets. Credit risk means the chance that you wont get all your money back market risk means the risk that the value of your investment can fluctuate.

The risk originating as a result of a financial instrument is not traded quickly in the market. The first is relevant to interest-bearing investments such as mortgage trusts and bank deposits - the second is. Market risk is a broad term that encompasses the risk that investments or equities will decline in value due to larger economic or market changes or events.

We review their content and use your feedback to keep the quality high. Credit Risk is the probability of a borrowers default and the subsequent Loss given default LGD. In the context of a fixed-for-floating interest rate swap and describe the conditions necessary for a credit loss to occur.

A complication is that the credit risk in a swap is contingent on the values of market variables. Buy this upes single question and download. Market risk arises from movements in market variables such as interest rates and exchange rates.

The chapter examined the origin of risks and. 11 i Explain the difference between credit risk and market risk. Such a risk arises as a result of adverse selection screening of applicants at the stage of acquisitions or due to a change in the financial capabilities of the borrower over the.

Financial Risk Types Of Financial Risk Advantages And Disadvantages

Belum ada Komentar untuk "Explain Difference Between Credit Risk and Market Risk"

Posting Komentar